TOGAF Principles to Architect a Scalable eComm/FinTech Platform for Kirana Stores

A few years ago, I had the opportunity to Architect a scalable eCommerce platform, with a forward-looking roadmap to integrate Fintech capabilities.

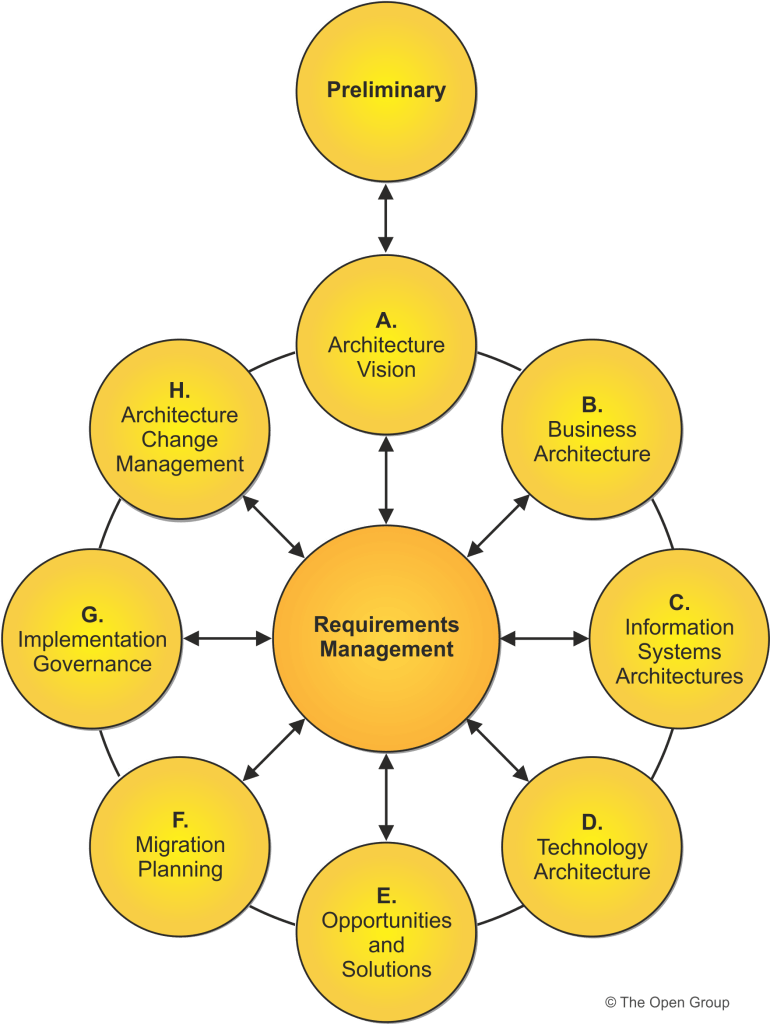

While TOGAF isn’t as commonly discussed today, my training (Certified in 2011 & expired) reminded me of the enduring value of structured Enterprise Architecture thinking.

I decided to apply TOGAF principles—particularly those that focus on business alignment, modularity, and governance—to guide this Project.

The Core Principle: Invest Only in Growth

From day one, I followed a principle of investing only where it drove measurable growth. As the platform’s usage and revenue scaled, it became feasible to Unlock deeper functionalities for both Buyers & Sellers. Technology decisions had to be tightly aligned with business goals—while ensuring scalability, agility, and responsible governance.

This post shares a High-level Architecture and Strategy Overview of the web and mobile solution that aimed to empower small retailers—especially, the Indian Kirana stores—with digital commerce and financial tools.

The GOAL: Increase financial inclusion at the bottom of the FMCG supply chain.

- Vision and Business Alignment – The platform was envisioned to enable:

Buyers: Discover and purchase goods via mobile/web, directly from local Kirana stores

Sellers (Kirana stores): Open their own online store with minimal cost through an ONSTAAS (Online Store As A Service) framework

Future Integrations: Access to Micro-Loan and embedded financial tools for sellers and buyers alike

Stakeholder Interviews were conducted with small store owners to understand real needs, followed by Capability modeling and Business scenario analysis to shape the solution.

Key Business Goals: Reduce costs and complexity in online transactions

Improve buyer retention—whether for single-item or bulk wholesale orders

Increase small sellers visibility online, enabling commerce with minimal tech effort

Streamline onboarding for both sellers and end-users

- Target Architecture Design (TOGAF Domains – Primary)

a. Business Architecture

Marketplace and future FinTech capabilities modeled as modular value streams and clearly separated

Seller onboarding, KYC, Order management and delivery were modeled as core flows

Roles and responsibilities clearly defined across Product, Finance, Risk, and Compliance

b. Application Architecture

Micro-services based backend for scalability and continuous delivery to enable rapid updates and feature releases

Mobile front-end built for Android and iOS platforms connected via secure API gateway

Integration with Payment gateways and KYC API/Services. (Only for Platform charges)

c. Data Architecture

A unified Customer 360 model to support personalization and Seller profiling/Seller Categorization

Minimal usage of PII, transactional, and behavioral data

No Financial transactions included on the Mobile platform to reduce Data risk and reduce costs on application security integrations.

All Financial Transactions, related to Sell & Purchase were directly between Buyer & Seller

Financial transactions for platform fees integrated with RazorPay / Stripe via Secured API’s

d. Technology Architecture

Cloud-native deployment (SAAS approach). As user base increases, this SAAS approach can utilize containerized services and auto-scaling

Identity and Access Management (IAM) with MFA, and OAuth 2.0, Social login integrations

Each of these domains can be further detailed out on the approach to a detailed granular level of Development and Implementation.

- Governance and Roadmap

A phased delivery roadmap aligned to capability increments and basis on business & revenue growth

KPIs linked to uptime, conversion rates, cand cost optimization

Continuous monitoring of User base, Seller Adoption & utilization, DAU, MAU etc. to take timely decision to upgrade or downgrade services to control expenditure

- Risk and Compliance

Considering Fintech space, risk mitigation had to be of utmost priority. The architecture included:

Restricted access controls and different screens for Buyer and Sellers with audit logging

Compliance with all Indian eCommerce regulations for online buying and selling as applicable

KYC for Sellers

- Scalability and Future Vision

The Solution was Designed with future states/capabilities in mind:

Plug-and-Play onboarding for additional fintech related services

Transition from neighborhood-only delivery to statewide fulfillment

MVP2: Micro-loan functionality for suppliers to stock goods as per the expected demand

MVP3: To enable the buyer to apply for the Consumer Loan directly from the Mobile App or Web Site

As an Enterprise Architect, the role isn’t just to deliver a working solution—it’s to build a Strategic Enabler and architect for resilience, growth, and innovation.

Would love to hear if someone has applied TOGAF Architectural Frameworks in modern Product Delivery and what worked for you?

#TOGAF #eCommerce #Fintech #DigitalTransformation #KiranaStores #SaaS